Is your trading strategy falling behind due to slow execution times? In the ultra-competitive field of high-frequency trading (HFT), milliseconds can be the difference between profit and loss. To keep pace, having the right HFT server is crucial.

In this article, we'll dive into the essential specifications and requirements of a high-frequency trading server, from processing speed to reliability and power management. Whether you're building your own setup or looking to upgrade, understanding these key factors can significantly enhance your trading performance.

High-Frequency Trading Server Specifications and Requirements

High-frequency trading (HFT) servers are engineered to execute trades at speeds thousands of times faster than traditional stock trading. This necessitates exceptionally high computational power and speed. For instance, the ORION HF210-G5 server, with its overclocked speeds of up to 5.3GHz, is designed to manage complex algorithms and ensure rapid transaction execution. The use of advanced mathematical models in HFT requires servers capable of handling vast amounts of data with minimal latency, making high-frequency CPUs and low-latency network interfaces critical.

Crucial components of an HFT server include:

- High-frequency CPUs

- Low latency network interfaces

- High-speed memory

- Efficient cooling systems

- Robust power management

Reliability and power management are paramount in HFT servers due to the need for continuous, uninterrupted operation. Financial services companies rely heavily on these servers to remain competitive, and any downtime can result in significant financial losses. Efficient cooling systems and robust power management ensure that the servers operate at optimal performance levels without overheating or power failures. These factors combined make reliable, high-performance servers indispensable in high-frequency trading environments.

Optimizing High-Frequency Trading Server Performance

Reducing latency is paramount for high-frequency trading (HFT) servers, as even microseconds can be the difference between profit and loss. Tick-to-trade delays, which measure the time from when market data is received to when an order is executed, must be minimized to enhance profitability. Advanced solutions like the TNS Ultra-Low Latency Layer 1 have been developed to address these needs, offering direct hardware-level connections to reduce latency dramatically.

Key optimization techniques for HFT servers include:

- Overclocking CPUs

- Using FPGA-based network devices

- Implementing low-latency network solutions

- Optimizing software algorithms

Managing heat and power consumption is another critical challenge in optimizing HFT server performance. High-frequency CPUs and overclocked components generate significant heat, necessitating efficient cooling systems to prevent thermal throttling and maintain optimal performance. Power management is equally important, as fluctuations can impact server stability. Solutions such as dynamic voltage and frequency scaling (DVFS) and advanced cooling technologies are employed to manage these issues effectively. Balancing these aspects ensures that HFT servers operate at peak efficiency without compromising reliability or performance.

Architecture and Configuration of High-Frequency Trading Servers

The architecture of high-frequency trading (HFT) servers is designed to maximize speed and efficiency in executing trades. A critical component of this architecture is the CPU. For instance, Hypertech's Orion HF server utilizes Intel's Sapphire Rapids CPUs, which offer up to 112 PCI Express lanes. Why are PCI Express lanes important? They allow for better peripheral integration, accommodating various high-speed components that are essential for HFT. The more lanes available, the more data can be transferred simultaneously, reducing bottlenecks and enhancing overall system performance.

Key configuration options and their benefits include:

| Configuration Option | Benefit |

| CPU Overclocking | Enhanced Speed |

| PCI Express Lanes | Better Peripheral Integration |

| CXL | Faster Data Transfer |

| PTM | Improved Synchronization |

In addition to the hardware components, technologies like Compute Express Link (CXL) and Precision Time Measurement (PTM) are integral to HFT server architecture. CXL facilitates faster data transfers between the CPU and other components, crucial for maintaining low latency. PTM, on the other hand, improves synchronization across the system, ensuring that all components operate in harmony. These technologies collectively contribute to the high-speed, low-latency environment required for effective high-frequency trading.

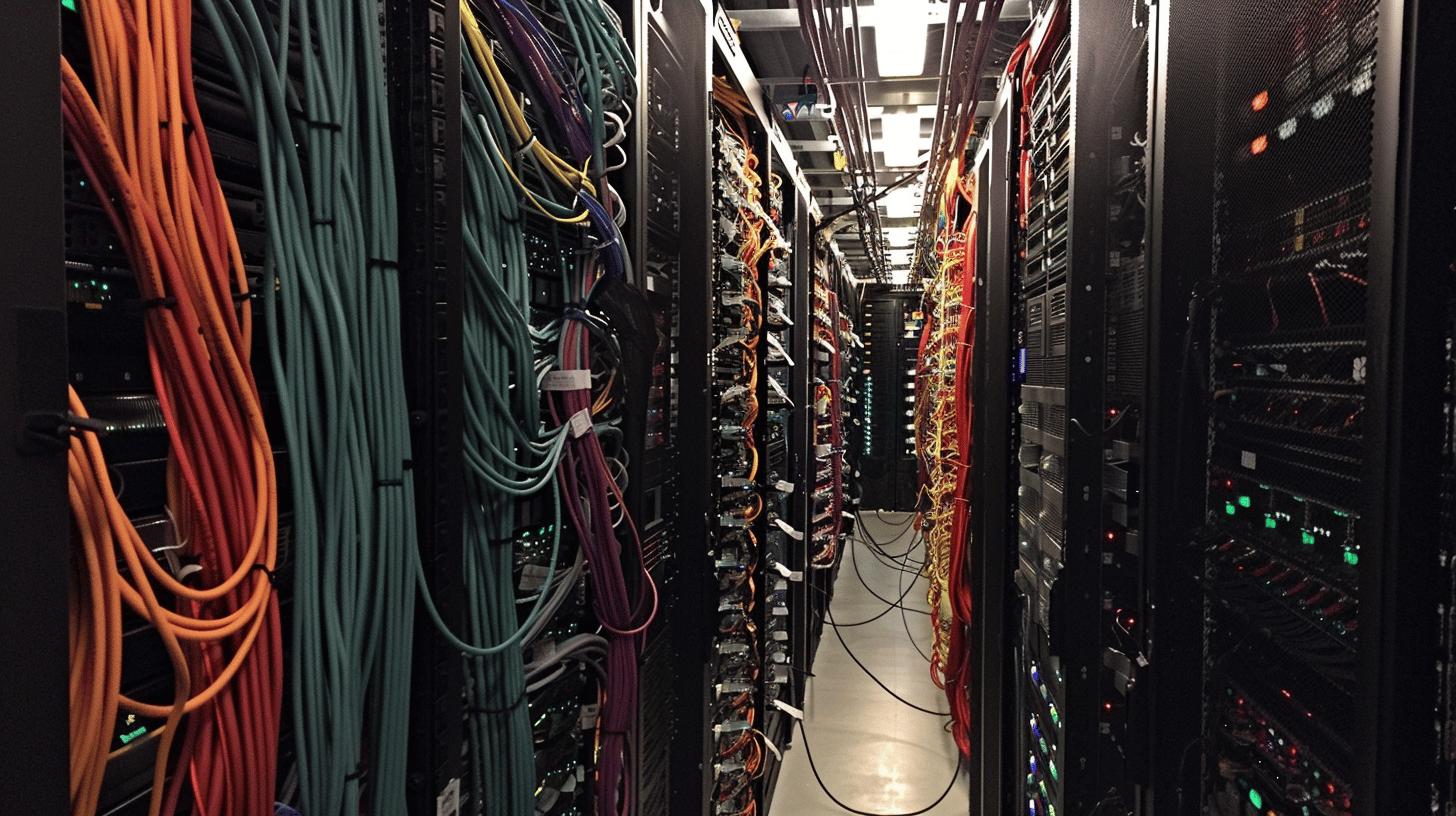

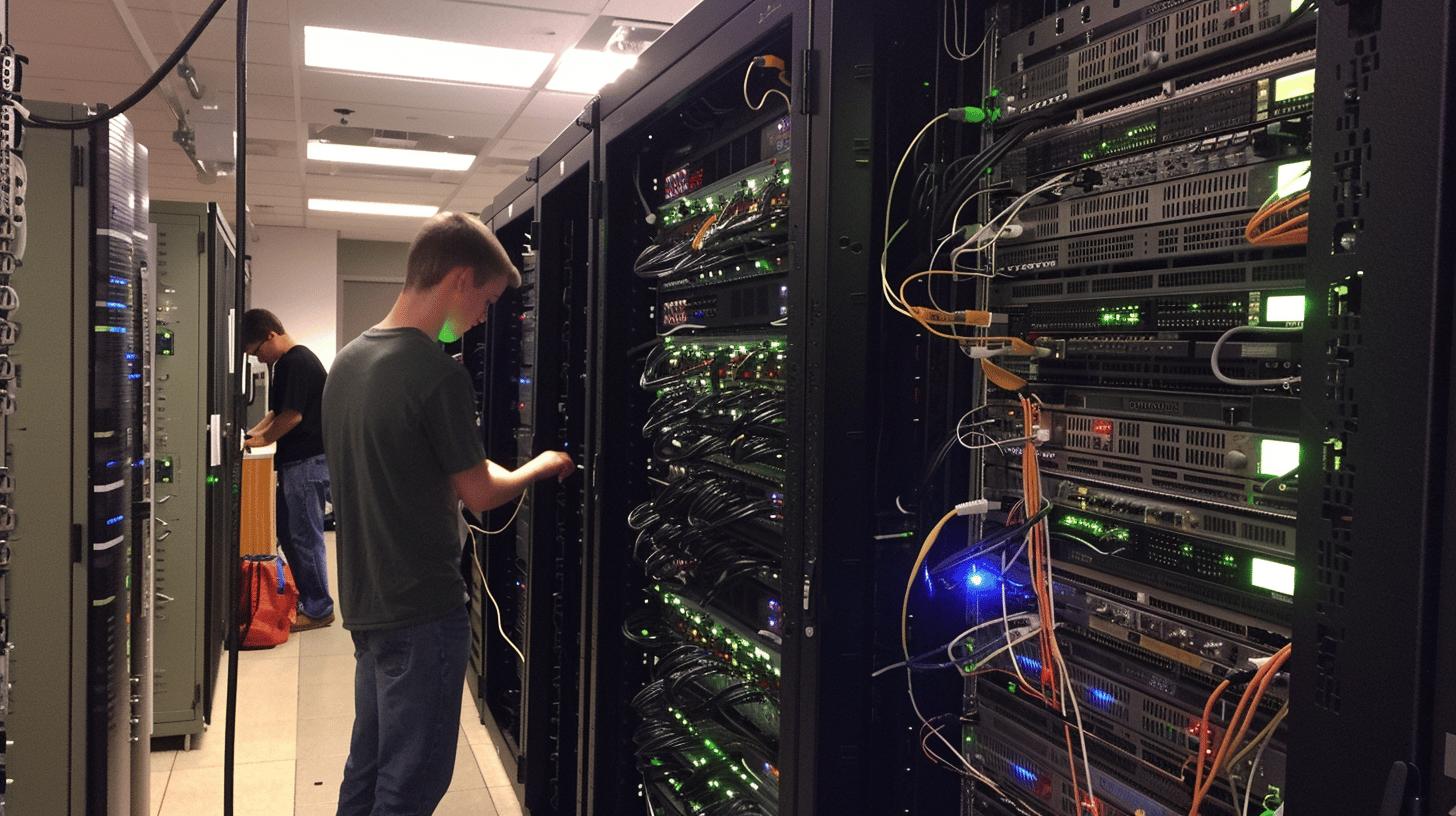

Selecting the right datacenter is also a critical aspect of configuring HFT servers. Whether opting for an exchange colocation or a generic data center, the goal is to minimize latency as much as possible. Exchange colocations offer direct market access, significantly reducing the time it takes for trade orders to reach the exchange. Conversely, a well-optimized generic data center can also provide low-latency connectivity, depending on its infrastructure. The choice of datacenter can significantly impact the overall performance of the HFT system, making it a vital consideration in the configuration process.

High-Frequency Trading Server Vendors and Solutions

Leading vendors in the high-frequency trading (HFT) server market play a pivotal role in providing the specialized platforms and infrastructure solutions necessary for HFT firms. Notable providers include OVHcloud and Beeks Group, which offer tailored platforms designed to meet the unique demands of high-frequency trading environments. These companies focus on minimizing latency and maximizing performance, essential factors for successful HFT operations. Additionally, 2CRSi, Dell Technologies Inc., and Exacta Technologies Ltd. are prominent players in the market, each offering a range of server solutions optimized for HFT applications.

Specific server models designed for high-frequency trading include:

- CIARA ORION HF210-G5

- Dell CRS3260

- Exacta PowerEdge R9

Vendor selection is critical for HFT firms, as the choice can significantly impact trading performance and operational efficiency. Each vendor provides distinct advantages, from CIARA’s ORION series, known for its overclocked speeds to minimize latency, to Dell’s CRS3260, which offers robust performance and reliability. Exacta’s PowerEdge R9 is another contender, designed to handle the high demands of HFT with superior computational power and efficient cooling systems. Selecting the right vendor and server model based on specific trading needs ensures that HFT firms can achieve optimal performance and maintain a competitive edge in the market.

Cost and Investment Considerations for High-Frequency Trading Servers

The costs for high-frequency trading (HFT) server solutions can vary significantly based on multiple factors. What influences the cost of HFT servers? The primary elements include the specifications of the server hardware, performance benchmarks that need to be met, and the extent of latency reduction required. High-frequency CPUs, low-latency network interfaces, and advanced cooling systems contribute to the overall cost. Additionally, the specific requirements for computational power and speed drive up the initial investment. Given these factors, it's clear that building an HFT server is not just about acquiring high-end components but also ensuring they meet the rigorous demands of HFT environments.

Key investment considerations include:

- Initial hardware costs

- Maintenance and upgrades

- Colocation fees

- Energy consumption

Market growth projections indicate a strong future for HFT servers. How is the HFT server market expected to grow? The HFT servers market is anticipated to grow at a compound annual growth rate (CAGR) of 4.24% from 2022 to 2027. This growth underscores the increasing reliance on robust digital finance frameworks to maintain competitiveness in financial markets. The financial impact of infrastructure choices cannot be overstated; selecting the right servers and ensuring they are optimized for low latency can provide a significant edge in trading performance. Therefore, a well-planned investment in HFT servers not only addresses immediate computational needs but also positions firms for long-term success.

High-Frequency Trading Server Performance Benchmarks

Performance benchmarks are critical in high-frequency trading (HFT) to ensure servers meet the stringent requirements necessary for executing trades at lightning speeds. Why are performance benchmarks important in HFT? They provide measurable criteria to evaluate a server's ability to handle high-speed data processing, low latency, and complex algorithms. For instance, the ORION HF210-G5 server, which boasts overclocked speeds up to 5.3GHz, exemplifies the level of performance required. Benchmarks allow firms to compare different servers and configurations, ensuring they select the most efficient systems for their trading strategies. High-density racks, now more common due to space optimization, also influence these benchmarks by affecting cooling solutions and overall system stability.

| Performance Metric | Benchmark Value |

| CPU Speed | 5.3GHz |

| Data Throughput | 4 Gbps |

| Latency | Sub-millisecond |

Data center configurations play a pivotal role in the performance of HFT servers. **How do data center configurations impact HFT server performance?** The layout and infrastructure of data centers, including cooling solutions and power management, directly affect server efficiency and reliability. High-density racks, while space-efficient, demand advanced cooling techniques to prevent overheating, which can lead to performance degradation. Additionally, market data microbursts, which can reach up to 4 gigabits per second, require servers to manage substantial data loads without bottlenecks. Properly configured data centers ensure that HFT servers operate at peak performance, maintaining the low latency and high throughput essential for competitive trading.

Future Trends and Innovations in High-Frequency Trading Servers

Emerging technologies such as Artificial Intelligence (AI) and blockchain are profoundly impacting the landscape of high-frequency trading (HFT) servers. How are AI and blockchain influencing HFT? AI and Chat GPT are being explored for their potential to enhance performance through advanced predictive analytics and algorithm optimization. These technologies can adapt to market conditions in real-time, offering a competitive edge. However, they also pose potential security threats, necessitating robust cybersecurity measures. Blockchain technology, on the other hand, promises to revolutionize transparency and security in transactions, making it a critical innovation for future HFT systems.

Key future trends in HFT servers include:

- Integration of AI and machine learning

- Adoption of blockchain technology

- Evolution of cloud-based HFT solutions

Market growth projections for HFT servers indicate a significant upward trajectory. What is the expected growth for the HFT server market? The high-frequency trading servers market is anticipated to grow substantially, driven by the increasing modernization of capital markets and the adoption of new technologies. Cloud computing is another trend that is set to transform HFT, offering scalable and flexible solutions that can handle the high computational demands of trading algorithms. The continuous evolution of these technologies will likely lead to more efficient, secure, and faster trading systems, positioning firms for long-term success in the competitive financial markets.

Final Words

High-frequency trading requires servers that excel in speed, computational power, and low latency. The right components—such as high-frequency CPUs, low latency network interfaces, and efficient cooling systems—are crucial for optimized performance. Meanwhile, managing heat and power consumption remains a significant challenge.

Choosing the right architecture and configuration, along with the best vendors, is vital. Costs and investments also play a critical role, with factors like hardware expenses and colocation fees impacting decisions.

Looking ahead, innovations such as AI, blockchain, and cloud computing will shape the future of high-frequency trading servers. Investing in the right high-frequency trading server can significantly enhance your trading operations and market competitiveness.

FAQ

What is an HFT server?

An HFT server is a high-frequency trading server designed to execute trades at extremely high speeds. It uses powerful computing systems and low-latency components to handle complex algorithms and process transactions faster than traditional stock trading systems.

Why is high-frequency trading illegal?

High-frequency trading is not illegal. However, it is subject to strict regulatory scrutiny due to concerns about market manipulation and unfair advantages. Regulations aim to ensure market integrity and prevent abusive trading practices.

Is high-frequency trading legal?

Yes, high-frequency trading is legal. It operates under regulatory frameworks established by financial authorities to promote transparent and fair trading environments. Compliance with these regulations is crucial for HFT firms.

Is high-frequency trading still profitable?

High-frequency trading remains profitable for firms able to invest in cutting-edge technology and infrastructure. Profitability depends on minimizing latency, optimizing trading algorithms, and maintaining robust risk management practices.